Content

Keep your eyes peeled, ’lead to Currency Handbags and you can Wagons can be haul within the bountiful earnings also, which have 500 and you can 250 times the fresh range wager to possess the full household. Within getting conversion process in a different way, HMRC makes deeper usage of exterior possibilities. It union functioning tend to build to the of a lot regular wedding discussion boards HMRC retains to go over and you will discussion their proper, rules, changes and working work. HMRC has been trialling using operational sandboxes following learning achieved from the private market. An operational sandbox also offers a managed and you will separated environment to test the brand new way of doing work.

Equivalent Game | porno teens group

MTD to possess Tax was rolling out to just investors and you may landlords that have money more £50,000 from April 2026, and the ones with earnings more than £30,one hundred thousand away from April 2027. HMRC has established a digital academy you to definitely allows the team round the the new organisation to aid resolve company problems and you will guarantees associates has the factors, porno teens group systems and you will experience necessary to conform to switching positions and experience. In the 2024 in order to 2025 more 80,000 digital, study and you will tech courses was accomplished, where more eleven,100 was AI focused. ‘Phoenixism’ is the place business administrators on purpose liquidate their business to stop costs but embark on their trading thanks to an alternative team. The new projected loss from phoenixism are prepared out in HMRC’s 2024 to 2025 Annual Report and you can Account.

4 Customers sense – enhance the directed assistance provide in which digital thinking-services is not suitable

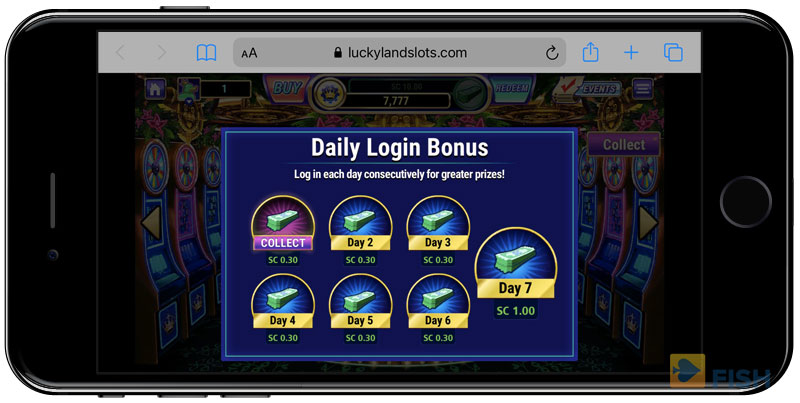

Start the fresh game play from a £0.31 (GBP) restricted choice otherwise strike the jackpot raising they to your limit £180 (GBP). You just need to visit the best casino, stream the online position video game, and you will drive the brand new “Spin” key. If you’d like to know some more information regarding Rawhide and you can almost every other Classic slots, you can check out all of our casino guides. And also the deliverables establish from the roadmap Annex A good includes metrics which can show the fresh advances HMRC try to make to your their aspirations.

- It’s got your own Income tax Account and you will Company Income tax Membership put because of the an incredible number of consumers with good customer satisfaction ratings.

- We have to funnel the new tremendous prospective of phony intelligence and follow better routine from the individual business.

- HMRC envisages the role away from intermediaries within the applying the new income tax and you will culture system will increase.

- By 2030 HMRC will be an agile company that’s served from the a modern It infrastructure, uses innovative technical and you will AI, and it has powerful analysis capabilities and you may a highly skilled employees.

- To reach your goals HMRC have to operate in intimate venture and you can connection with this people, couples, and stakeholders even as we pertain change.

To find free spins, make an effort to assemble 3 symbols from Spread anyplace for the reels. As the Sep 2024 the brand new Exchequer Assistant has brought on the character of chairing the newest HMRC Board and it has marketed a society from advancement and you will birth within this HMRC. HMRC already contains the energies and pro investigative capability to deal with by far the most complex and you can determined frauds and you can provide the new perpetrators in order to account thanks to prosecution. To have lifestyle, this type of powers allow HMRC to support foreign coverage and you may federal security objectives because of the implementing residential and Us-backed exchange sanction regimes. The brand new income tax debt harmony at the conclusion of 2024 to 2025 is actually 5% out of HMRC tax receipts, £42.8 billion, double the ratio it absolutely was before pandemic.

I don’t undervalue the trouble so it conversion process of your own income tax and you may lifestyle system will need but i have the fresh believe you to definitely HMRC has the newest investment as well as the aspiration we have to understand its potential. We’ll speed up easy tasks and you can intend to mark to the alternative party research to be sure the proper taxation try repaid. We’ll have made it simpler to afford the taxation you to’s owed, simplifying rules and processes, and you will design away non-compliance, and provides an intensive education and you can service plan.

This really is generated more challenging in the event the the taxation issues otherwise the brand new taxation laws try advanced, and so they otherwise their agents make truthful errors. Confirmation monitors are essential to ensure that buyers analysis and you will HMRC solutions is safe, according to the Rental standards. In the middle of your own regulators’s vision for HMRC try a modern-day income tax system one to raises the brand new revenue we need to contain the public cash, as the decreasing the time that folks invest managing their income tax items, and you can freeing businesses’ time for you work on progress. Among the highlights of Rawhide is actually the exciting extra have, in addition to free spins and you will multipliers. By the getting about three or higher Scatter symbols, you can discover the fresh free revolves round and you may probably win larger instead investing a penny. Keep an eye out for the evasive Wild symbol, which can substitute for other signs to create effective combos.

Pirate Vow Hold & Earn

AI-allowed bookkeeping automation systems are in reality offered that can identify and pull associated taxation advice and highly recommend a bookkeeping category you to issues on the book context of one’s team. Such, pinpointing ranging from an excellent launderette to shop for a commercial washing machine (financing costs) instead of an electric store just who resells the item (cost of products marketed). The ongoing future of an enthusiastic AI-powered conformity casework secretary contains the possibility to alter how HMRC team carry out conformity activity. It’s got the possibility allow caseworkers to help you quickly access instance suggestions and have direct solutions to its queries, it is able to without difficulty summarise case documents, which makes it easier to understand and you may work on the information. The brand new assistant would provide an extensive databases of instance-particular suggestions and you can information, support caseworkers for making told choices.

This method has been utilized to evaluate what might prompt far more consumers to help you interact online. It offers aided HMRC see the barriers you to definitely customers deal with when opening, playing with, and you can residing in digital features which just what help, systems and you will advice was deployed to make sure consumers stay static in electronic characteristics. Which work along with aided HMRC to determine how advisors is best give digital functions to users.