Investors, stockholders, financial-rating agencies and the Internal Revenue Service want to know the information posted in ledgers at the end of the fiscal quarter or year for various reasons. For example, investors want to see the income and liabilities you posted in the general ledger to evaluate the health of the company. Investors are not concerned with the information you recorded in your accounting journals. Good accounting practices enable businesses to track their cash flow, manage expenses, and assess the financial health of their operations. Through accurate posting, businesses can also detect discrepancies, fraud, and financial irregularities, allowing for timely corrections to prevent potential losses.

- The fourth step is to calculate the running debit and credit balance for each account.

- Posting only transfers the total balance in a subledger into the general ledger, not the individual transactions in the subledger.

- Transfer in general ledger takes place with the name of the account and amount carried forward in subledger or general journal along with entry details.

- Without proper posting, it would be challenging to prepare accurate financial statements or identify errors in the accounting system.

- Debits decrease balance sheet liability accounts, such as notes payable, and shareholders’ equity accounts, such as retained earnings.

Enter the Debits and Credits

This method is suitable for businesses with straightforward financial transactions, as it allows for a simplified approach to bookkeeping and financial management. By recording only the cash aspects of transactions, it provides a clear overview of cash inflows and outflows. This approach is particularly beneficial for businesses that primarily deal with cash, such as small retail stores, local service providers, and sole proprietors.

Improve staff payment posting accuracy with these steps

This way we can total each account and keep track of it’s balance at all time during the year. Such uniformity guarantees there are no unequal debits and credits that have been incorrectly entered during the double-entry recording process. However, a trial balance cannot detect bookkeeping errors that are not simple mathematical mistakes. Companies initially record their business transactions in bookkeeping accounts within the general ledger. If entries are not posted in accounting, the financial records will be incomplete and inaccurate.

Wider support available for automation

This process plays a crucial role in maintaining the accuracy of ledger accounts, as it ensures that all transactions are systematically recorded and categorized. By systematically transferring journal entries to the ledger, it becomes easier to analyze and track the movement of funds within the organization. A trial balance is a list and total of all the debit what is posting accounting and credit accounts for an entity for a given period – usually a month. The format of the trial balance is a two-column schedule with all the debit balances listed in one column and all the credit balances listed in the other. The trial balance is prepared after all the transactions for the period have been journalized and posted to the General Ledger.

Posting In the Closing Process

Modern computer programs allow you to correctly prepare the necessary and important reports in a short time. Within the established time frame, warehouse managers and Department managers submit these reports to the organization’s accounting department. Mentioning the date of transaction is the second step of posting a journal entry. Depending on the software used, similar modules exist to allow automated postings for payroll, inventory control, purchases order processing, sales order processing, fixed assets, job costing and bill of materials. After all accounts are posted, we can now derive the balances of each account. As shown in the ledger above, the company has $7,480 at the end of December.

Step 1: Check you can use automation

Conduct regular training sessions or webinars, and provide up-to-date manuals. Develop and enforce clear policies and standards for handling various payment posting scenarios. The final step in the posting process is to check for mathematical and data transfer errors. Accounting software packages may reduce these errors through automation, but verifying the numbers is a prudent step that prevents errors from propagating to the financial statements. Debits increase balance sheet asset accounts, such as cash and inventory, and increase income statement expense accounts, such as marketing and salary expenses. Debits decrease balance sheet liability accounts, such as notes payable, and shareholders’ equity accounts, such as retained earnings.

It is very helpful and useful in large organizations, as keeping track of the balance becomes very easy. Also, with the posing in a ledger, the arithmetic accuracy of the accounts can be verified, and the balances can be analyzed thoroughly to maintain the proper and accurate records. A well-designed automated posting system provides clear, organized financial reporting, enhancing visibility into revenue streams and facilitating more informed financial management decisions.

A bookkeeping expert will contact you during business hours to discuss your needs. A general ledger contains accounts that are broad in nature such as Cash, Accounts Receivable, Supplies, and so on. It consists of accounts within accounts (i.e., specific accounts that make up a broad account).

Posting is the transfer of journal entries to a general ledger, which usually contains a separate form for each account. Journals record transactions in chronological order, while ledgers summarize transactions by account. Accurate posting of cash transactions ensures compliance with accounting standards and regulations, enhancing transparency and reliability in financial reporting. It is an integral part of maintaining a clear and updated picture of the company’s financial standing. This organized financial information is essential for making informed business decisions and preparing financial statements.

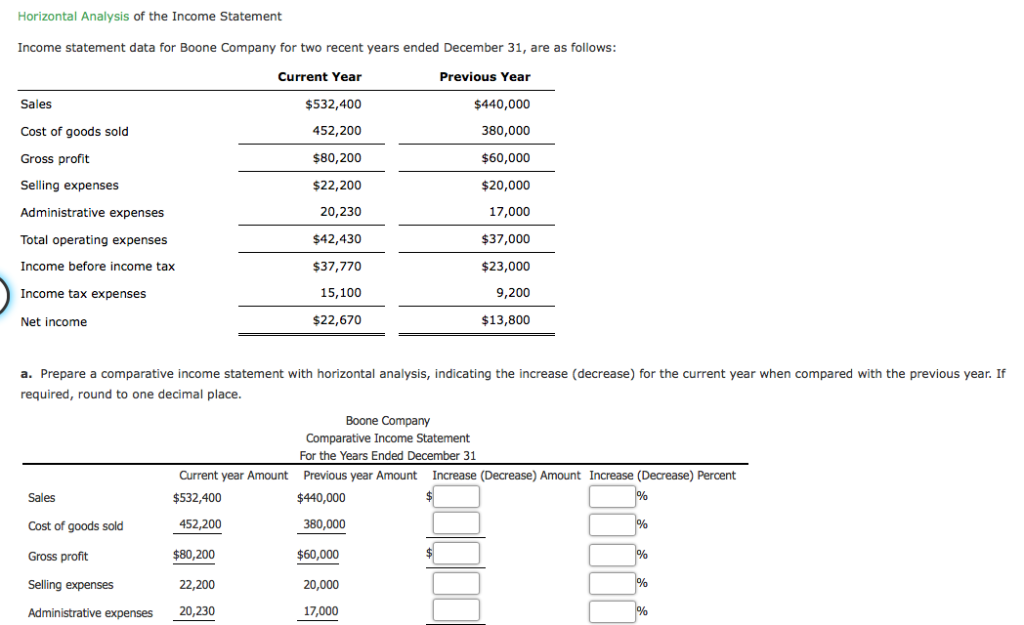

Debits and credits of a trial balance being equal ensure there are no mathematical errors, but there could still be mistakes or errors in the accounting systems. If an income statement is prepared before an entity’s year-end or before adjusting entries (discussed in future lessons) it is called an interim income statement. The income statement needs to be prepared before the balance sheet because the net income amount is needed in order to fill-out the equity section of the balance sheet. The net income relates to the increase (or in the case of a net loss, the decrease) in owner’s equity.