Your assets are worth $10,000 total, while your debt is $5,000 and equity is $5,000. In accounting, the company’s total equity value is the sum of owners equity—the value of the assets contributed by the owner(s)—and the total income that the company earns and retains. A balance sheet is limited due its narrow scope of timing. The financial statement only captures the financial position of a company on a specific day.

How does the accounting equation assess assets, liabilities, and equity?

- Assets include cash and cash equivalents or liquid assets, which may include Treasury bills and certificates of deposit (CDs).

- The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed.

- Along with Equity, they make up the other side of the Accounting Equation.

- This basic accounting equation “balances” the company’s balance sheet, showing that a company’s total assets are equal to the sum of its liabilities and shareholders’ equity.

- This is the total amount of net income the company decides to keep.

A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, on the other hand, are due at any point after one year. Accounts within this segment are listed from top to bottom in order of their liquidity. This is the ease with which they can be converted into cash.

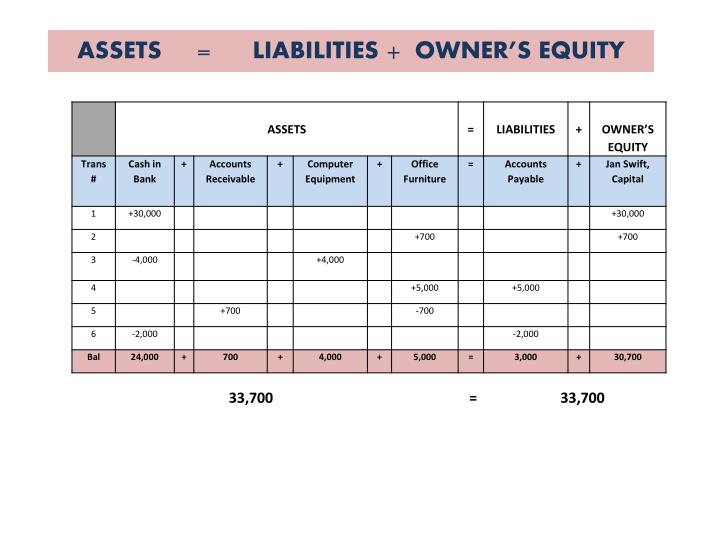

Example of a Balance Sheet

The income statement is the financial statement that reports a company’s revenues and expenses and the resulting net income. While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time. The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets. The accounting journal entry for accrued income or income due equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity. As a core concept in modern accounting, this provides the basis for keeping a company’s books balanced across a given accounting cycle. As you can see, no matter what the transaction is, the accounting equation will always balance because each transaction has a dual aspect.

The Financial Modeling Certification

As noted above, you can find information about assets, liabilities, and shareholder equity on a company’s balance sheet. The assets should always equal the liabilities and shareholder equity. This means that the balance sheet should always balance, hence the name. If they don’t balance, there may be some problems, including incorrect or misplaced data, inventory or exchange rate errors, or miscalculations. On the balance sheet, the assets side represents a company’s resources with positive economic utility, while the liabilities and shareholders equity side reflects the funding sources. The Accounting Equation is a fundamental principle that states assets must equal the sum of liabilities and shareholders equity at all times.

For this reason, a balance alone may not paint the full picture of a company’s financial health. Below liabilities on the balance sheet is equity, or the amount owed to the owners of the company. Since they own the company, this amount is intuitively based on the accounting equation—whatever assets are left over after the liabilities have been accounted for must be owned by the owners, by equity.

If your business uses single-entry accounting, you do not use the balance sheet equation. Well, the accounting equation shows a balance between two sides of your general ledger. Single-entry accounting does not require a balance on both sides of the general ledger. If you use single-entry accounting, you track your assets and liabilities separately. You only enter the transactions once rather than show the impact of the transactions on two or more accounts. All assets owned by a business are acquired with the funds supplied either by creditors or by owner(s).

By its very nature, a balance sheet is always based upon past data. While investors and stakeholders may use a balance sheet to predict future performance, past performance is no guarantee of future results. Liabilities are debts (aka payables) that you owe to others. Company credit cards, rent, and taxes to be paid are all liabilities. Do not include taxes you have already paid in your liabilities. Regardless of how the accounting equation is represented, it is important to remember that the equation must always balance.

Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. With liabilities, this is obvious—you owe loans to a bank, or repayment of bonds to holders of debt. The interest rates are fixed and the amounts owed are clear. Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds are given out. With liabilities, this is obvious – you owe loans to a bank, or repayment of bonds to holders of debt, etc.

Alternatively, suppose the company decided to borrow $100 to buy the chair as opposed to using its own cash. Then the PP&E will go up by $100, so Assets increase by $100. But Debt will also go up by $100 because the company had borrowed the money. This matching impact increases Liabilities & Equity by $100.

Even though we have multiple entries with varying amounts, our accounting equation still balances. In the accounting equation, assets must always balance with liabilities and equity. Every transaction that increases or decreases value on one side of the equation must be matched on the other side of the equation. This is why the accounting system used with the accounting equation is called a double-entry system. Double-entry accounting uses the accounting equation to show the relationship between assets, liabilities, and equity.