Gold IRAs

Goldco earned the Stevie Company of the Year Award 19th Annual American Business Awards in 2021. When you’re ready to start the gold IRA process, you can’t go wrong with these recommendations for the best gold IRA companies. Noble Gold Investments requires a minimum investment of $2,000 to open precious metals IRAs. An IRA account provides a great opportunity for individuals to save and secure their financial future. With Noble Gold, customers can rest assured that their gold IRA investments are in good hands. However, choosing the best Gold IRA company is crucial for success, as not all companies offer the same level of service, security, and reliability. Hold your gold until maturity: If you need access to your IRA funds, you can take distributions from your gold IRA like a traditional IRA. These ratings are based on past customers’ evaluations of Augusta’s services. Read our editorial standards. The company has competitive pricing, making it an appealing option for anyone interested in precious metals investments. This includes information on buying gold within an IRA account, the Federal Reserve System, Social Security benefits and tips for diversifying your retirement portfolio. Investing is not limited to only stocks and bonds.

Pioneering the Future: Aurora Conference unites global tech leaders in Helsinki to explore Finland’s DAO Governance prospects in the next decade

Do you know that precious metals IRAs also have unique tax advantages. The company specializes in helping individuals diversify their wealth with investment grade gold and silver. How can I access my investments when https://superoferta.digital/how-to-start-a-business-with-gold-ira-tax-rules/ I’m ready to do a distribution or take possession of my gold or silver. Some gold IRA companies cover storage fees for you, while others tack them on to your monthly or annual account maintenance fees. GoldCo: A Top Choice for Precious Metals IRA Custodianship. The best way to invest in gold will depend on your individual investment goals and objectives. Birch Gold Group is one of the best gold IRA companies because they make it easy to build wealth and help new customers like yourself get into these investments.

Gold IRA: Frequently Asked Questions

A Gold IRA is very similar to a traditional IRA Individual Retirement Account that provides you with certain tax advantages. Plus, you will need to be sure that your gold is stored securely. Entrust reviews the depository’s audit and matches it to your dealer’s invoice. However, gold acts as a hedge against inflation. More and more Americans are taking advantage of bargain gold prices by adding the yellow metal to their retirement portfolios. You can even download reports to your computer and then use them to create your own customized portfolios. The process required extensive research into the services offered by gold IRA companies, the fees associated with each company, and gold IRA companies reviews. The good news about investing in a gold IRA is that there are no set in stone requirements when it comes to how much money you need to start investing. Get a sneak peek of life as an entrepreneur behind the scenes in our Techstars programme here. The same withdrawals rules apply as well. Most financial advisors recommend limiting gold to a small portion of a balanced portfolio. Discover the Luxury of Oxford Gold and Start Enjoying Quality Jewelry Today. Make sure to ask as one of these promotions might be enough incentive to choose one company over another.

Wrap Up

Their services are backed by a team of experienced professionals, providing customers with the security and guidance they need to make informed decisions about their gold investments. When considering a gold IRA, investors should consider the fees associated with the account. It also offers a buy back commitment and no back end fees, helping you feel more confident in your investment. Ensure you speak with your financial advisor before deciding if investing in gold is appropriate for you based on your unique personal and financial circumstances. Click Here to Learn More About Oxford Gold. We have found Augusta to be a trustworthy company that deserves our number two position because of its dedication to transparency. Refer to a professional for investment advice. When prices drop sharply because there’s less demand like during the Great Depression people often look for a safe place to store their money. Birch Gold Group Runner up. Just make sure you invest with a reputable gold IRA company who you feel comfortable with. Anyone can access educational resources including articles, videos, and downloadable guides. Augusta is a popular choice for investors because of its commitment to customer satisfaction and ethical business practices. However, it’s important to keep in mind that the price structure of this company is fundamental.

The British energy revolution

As a result, all the paper investments you hold need to increase in value by a higher rate than the inflation rate to remain profitable. RC Bullion: Best for Bullion Purchase. Gold IRA reviews can be a great starting point to help investors find the right custodian or broker for their gold IRA. First, you need to choose a reputable and experienced company. The company prides itself on avoiding hard sales, which can be a relief if you’ve been shopping around for a reliable precious metals IRA. Kindly note that some custodians will be willing to waive some fees or reduce their percentage cuts during the first couple of years, mainly if you have a massive account balance and are committed to a long term arrangement. Discover the Benefits of Joining Patriot Gold Club Today.

2 American Hartford Gold Group: Best For Portfolio Diversification

In the Great Depression of 1929, thousands of people lost fortunes buying stocks and shares because they thought the stock market would continue to rise forever, a bit like today’s empty stock market rallying. Meanwhile, the annual storage fee with the Delaware Depository starts at $100 and goes up $1 per every additional $1,000. Gain on asset and investment sales, included in Gain on asset and investment sales, net, primarily represents the gain on the sale of the Kalgoorlie Power business, gain on the NGM Lone Tree and South Arturo exchange, and gain on the sale of TMAC. These services include helping clients to set up their gold IRA account, providing advice on the types of gold investments that are allowed in a gold IRA, and performing the necessary paperwork for the purchase, sale, and storage of gold. Learn more about our Wealth Planning services or contact your qualified tax advisor. Gold usually goes up in value as paper assets go down. Similar to silver, platinum is predominantly found in the industrial sector. We offer the most straightforward, complete precious metals IRA program in the industry.

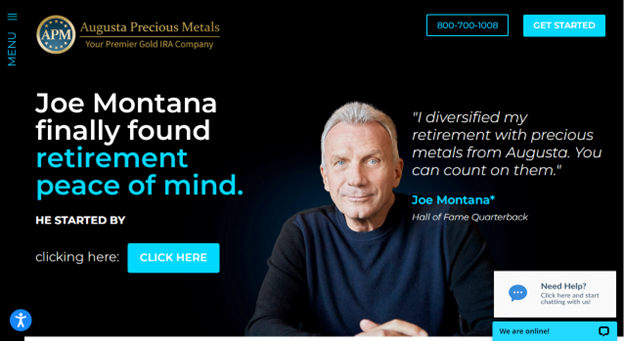

1 Augusta Precious Metals Beverly Hills, California

A gold IRA is one way to save for retirement. The company has a reliable team of experts that provide comprehensive services and guidance to their clients. The price of gold from a top quality approved depository will often be higher than gold from a lesser known facility. A professional engineer turned advisor, he provides comprehensive financial planning, cash flow management, and investment management services. The package will then be sent to your depository, and most importantly, processed completely free of charge. If you’re ready to secure your financial future with a gold IRA, consider American Hartford Gold.

Gold

Reputable gold IRA custodians should be regulated by the IRS and have a strong reputation within the industry. Patriot Gold stands out from the competition due to their commitment to providing top notch customer service and their dedication to helping their clients make the best gold IRA decisions. American Hartford Gold is one of the best gold IRA companies. Coins are cheaper to deliver since they’re lighter and don’t call for as much security. Experience the Quality of GoldCo and Make Your Investment Dreams Come True. If you’re still employed, you may do a partial rollover if you meet age minimums. Processes such as those involved in converting a regular IRA into a gold IRA can be really murky and that is where the experience and know how of a firm like American Hartford Gold can come in very handy.

Can I recharacterize a rollover or conversion to a Roth IRA?

RC Bullion is known for its transparent pricing and expert advice on precious metal investments. It isn’t much, but for small investors, these could sum up to represent a significant percentage of their investment. And instead of owning only paper assets, it can be reassuring to know that at least some of your retirement investments are assets you can see and touch. The US Congressmen Alex Mooney proposed that the US dollar be backed by gold because of the continued inflation we’re seeing across the country and the world. Every one of the firms received an A+ rating from the Better Business Bureau. It will consist of the following. Discover Financial Freedom with Noble Gold’s Secure Investment Solutions. Augusta Precious Metals. Every other storage provider in GoldCo’s storage network is also certified by the IRS and the Securities and Exchange Commission. Although its specialty lies in wealth and asset protection, there is so much more to this precious metals IRA company than that. Not only is it ranked 20 in the Inc 500 2022 list, but it’s also an official member of the Forbes Finance Council. And unlike other depositories, BlueVault provides segregated storage only, which means your bullion is never intermingled with others. By submitting this form you may also receive market alerts. The accuracy and depth of information on this website are outstanding.

What I like/dislike about Goldco Precious Metals

When it comes to finding the best gold IRA companies, investors have plenty of options to choose from. Additionally, precious metals IRAs offer tax deferred growth potential and potential tax free withdrawals. The storage costs between $100 and $150, depending on the depository and the type of vault that you use. After speaking with a support agent, we can confirm that there is a flat $180 annual fee. Their website mentions a set up fee and annual fees, there was no mention of the exact amount. And with the Federal Reserve’s recent prediction of a “mild recession” in 2023, many Americans are considering gold as a safe haven for their hard earned savings. They can help investors compare the fees, services, and features of each option. We also found Goldco’s in depth blog, eBooks, and educational videos very helpful for potential investors. At Noble Gold, they make it easy for you to transition your assets into a new IRA account by allowing direct transfers from an existing custodian. Only offers storage in Switzerland.

8 Best Glucosamine For Dogs In 2023

As one of the top gold IRA companies, Noble Gold is committed to providing excellent customer service and secure storage for gold investments. According to recent research, the top gold and silver IRA companies offer their clients competitive pricing, excellent customer support, and reliable information. By taking these steps, the team was able to provide a fair and accurate assessment of the gold IRA companies. If you provide, your name and contact details they will also provide you with a free guide. Compare different companies to find the most competitive pricing. Limited availability,. However, often the opposite is the case. Experience the Exceptional Service of GoldCo – Try It Today. The concept of inflation includes the value of the dollar steadily declining over time. American Hartford Gold. IRA terms of 3, 5, or 10 years.

Asset Allocation % of net assets

Gold coins, or one ounce silver coins minted by the Treasury Department. This is another company in California, but thankfully, it’s online. They offer tax advantages, as well as the potential for long term growth. Silver assets, such as silver bullion coins or bars, are high potential investments since they are authentic, physical assets. If a gold dealer would recommend investing all your capital into precious metals, the company does not have your best interest in mind. At times, the process may seem overwhelming, but with the experts in gold IRA rollovers by your side you will have the best chances of success. Our Home Storage IRA assistance and guidance saves clients thousands of dollars setting up a complex legal structure. Annual Fees: $180Storage Fee: $ 150Gold IRA Min: $ 20,000Non IRA Min: $ 3,500Promotion: $ 10,000. Can I store my precious metals IRA at home or in a bank. Historically, gold has proven itself as a reliable investment by keeping up with inflation despite long periods of both underperformance and overperformance. Your precious metal dealer may recommend that you open an IRA with a custodian like STRATA, because federal law requires that you have an IRA custodian to handle the administration, custody and reporting needs for your IRA.

CONS

This focus on education gives you the peace of mind that you’re working with an upfront company that wants to make sure your investments work for you, not the other way around. Birch Gold Group can facilitate 401k to fund your precious metals IRA. Furthermore, the custodian of the gold IRA must provide periodic statements detailing the value of the metal and its performance. Silver and Platinum IRA: 1. When you reach 72 years of age 73 starting in 2023 and must take distributions, then you may choose to take distributions in physical precious metals,provided the IRA contains precious metals of the appropriate value. Check out some of the companies featured in these gold IRA reviews. Gold is a timeless and reliable asset that can provide long term financial security and stability during retirement. Indeed, there are many gold IRAs beyond the seven that I’ve reviewed here. Lear Capital has a simple and transparent billing structure. And for the right reasons, the performance of gold has far surpassed the performance of the equity market or real estate as seen for the last 10 years. Overall, your demands and retirement objectives are unique. Secure Your Retirement with Advantage Gold’s IRA Options. 999 fine or 999 fine silver; platinum is.

Own Specific Serial Numbered Bars

The IRS details regulations regarding the storage of any physical gold, silver, platinum, or palladium that backs an IRA. You have to hold your gold or silver in a facility approved by the IRS, which means you have to stick with one of a handful of depositories located across the United States. Red Rock Secured is a wise choice for anyone looking to protect their wealth with a precious metals IRA. Privacy Policy Terms of Use Do Not Sell My Info Sitemap. We will also point out the pitfalls and which gold IRA companies you should avoid with your retirement savings. The first step is to create an investment profile to determine the appropriate types of products for you. Ask them questions about the types of gold they offer, their storage and delivery policies, and their experience in the gold IRA industry. More often than not, a legitimate IRA company will also do business with equally legitimate dealers. The website has real time prices of various purchase options and locks in that price for ten minutes, giving customers plenty of time to complete their purchase at the price they expect.

Get The FREE 2023 Gold IRA Kit from Goldco

Like us on Facebook to see similar stories. You can maintain a healthy financial portfolio with gold IRAs while enjoying greater control over your money. Investing in gold can potentially diversify your retirement portfolio and serve as a hedge against inflation and market volatility. No hard sell policy. Discover the Value of Augusta Precious Metals: Invest in Quality Precious Metals Today. These include market fluctuations, which can impact the value of your precious metals, and potential changes in government regulations affecting IRAs. To get started opening an account with Red Rock Secured, you can click here. One of the biggest benefits of investing in a gold IRA is that it can help you diversify your portfolio. The gold is typically stored in an approved depository. If you are not yet 59. Is there a gold Roth IRA. Federal income tax treatment accorded to a regulated investment company “RIC”, the Fund must derive at least 90% of its gross income in each taxable year from certain categories of income “qualifying income” and must satisfy certain asset diversification requirements. It has several celebrity ambassadors, including Sean Hannity, Chuck Norris, and Ben Stein.

Benefits

As a customer, you’ll have total peace of mind throughout the entire Gold IRA rollover/transfer process. To qualify to be held within a precious metals IRA, gold, silver, platinum and palladium are required by the IRS to meet certain standards of purity and fineness. No official buyback plan. Read through these and consider if they’re dealbreakers or not. With over 30 years of experience, RC Bullion is a great choice for customers looking to invest in gold. Gold IRA companies also often provide education and professional advice on precious metals investments. Furthermore, investors should consider the transparency of the company and whether they provide easy access to their performance metrics and other key information.

FOLLOW BLUEVAULT

Like any other precious metals IRA company, American Hartford Gold promises some services and features that will be worth the while such as competitive product pricing and reasonable fees. Traditional IRA users must start taking an annual distribution from their accounts no later than April 1 in the year after turning 72 years, irrespective of their employment status. Sometimes this amount does not meet the minimum investment threshold required by your gold dealer. Many people choose to operate several retirement accounts at once. In the world of Gold IRAs, I look beyond the basics, and find not only the best companies, but what really sets them apart. Experience the journey of precious metals investing with Noble Gold Investments as your trusted partner. This is a simple process and should take less than ten minutes. If you’re ready to get started opening an account with Oxford Gold Group, you can click here or call a representative at 877 544 1523. Reviews of the Best Gold IRA Companies Final Thoughts. The best way to find a good provider for your Precious Metals IRA is to ask family and friends for referrals. My rep at Goldco has kept me informed about the precious metals market. Noble Gold: Good for smaller gold investments. Buy IRA approved metals: Per IRS rules, you can hold only certain types of gold and precious metals in an IRA. Advantage Gold was founded in 2014 by Adam Baratta and Kiril Zagalsky.

100% of our website is encrypted and we never share your info!

With a gold backed IRA from Augusta Precious Metals, investors can rest assured that their gold backed IRA is backed by a reliable and trustworthy provider. Discover the Benefits of Investing with GoldBroker: Start Your Journey Today. TrustLink has given them 5/5 stars from 123 reviews, and Business Consumer Alliance has given them a double A rating from 4,723 inquiries. If you’re considering opening a gold IRA, your best option will depend on which company best suits your personal financial needs and goals. Clients also benefit from the company’s low fees and fast turnaround times. Ensure the safety of your investments with our certified storage solution. Luckily, Goldco will send you a comprehensive guide free of charge. You can diversify your gold retirement account with stocks in gold companies, mutual funds and exchange traded funds linked to gold prices, and even gold futures to give you a stable investment that still focuses on precious metals. You can pick which custodian will hold your gold for you. Whenever making an investment decision, please consult with your tax attorney or financial professional. Aside from being a more stable option, these companies simply have more potential for growth in the future. Weighing the pros and cons of a gold IRA can help with this important investment decision. Experience the Benefits of Joining the Patriot Gold Club Today. Many people choose to invest in a gold IRA because they believe it will provide them with more stability and security than other traditional investments.